If you already own a home, have you ever stopped to think about how much wealth you’ve built up just from being a homeowner? As home values rise, so does your net worth. And, if you’ve been in your house for a few years (or longer), there’s a good chance you’re sitting on a pile of equity — maybe even more than you realize.

What Is Home Equity?

Home equity is the difference between what your house is worth and what you owe on your mortgage. For example, if your house is worth $500,000 and you still owe $200,000 on your home loan, you have $300,000 in equity. It’s essentially the wealth you’ve built through homeownership. Right now, homeowners across the country are seeing near-record amounts of equity.

According to the Intercontinental Exchange (ICE), the average homeowner with a mortgage has $319,000 in home equity.

Why Have Homeowners Gained So Much Equity?

The rise in equity can be credited to two key factors:

1. Significant Home Price Growth

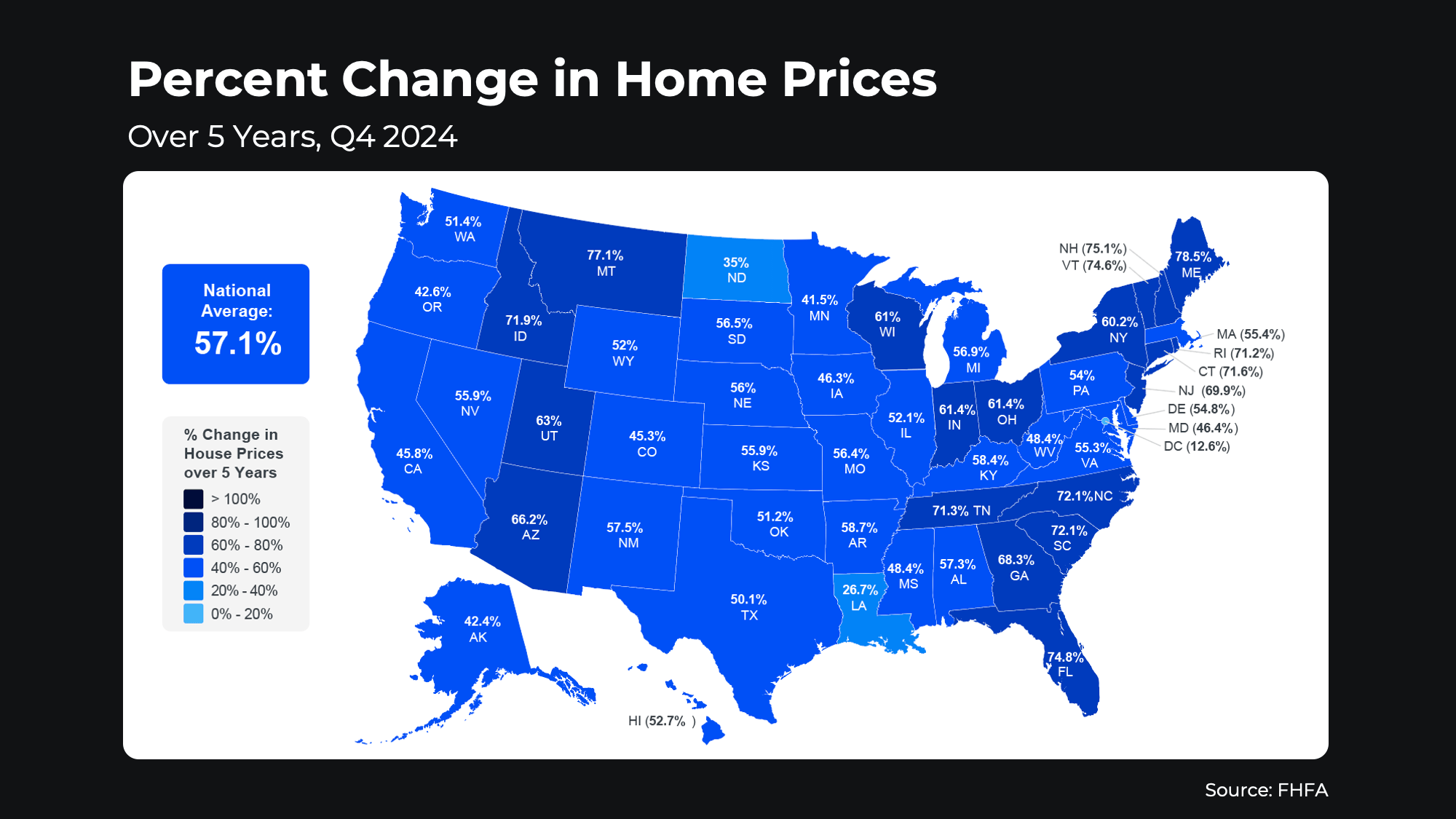

Home prices have climbed dramatically in recent years. In fact, according to the Federal Housing Finance Agency (FHFA), over the past five years, home prices nationwide have risen by 57.1% (see map below):

This appreciation means your house is likely worth much more now than when you first bought it.

This appreciation means your house is likely worth much more now than when you first bought it.

2. Longer Tenure in Homes

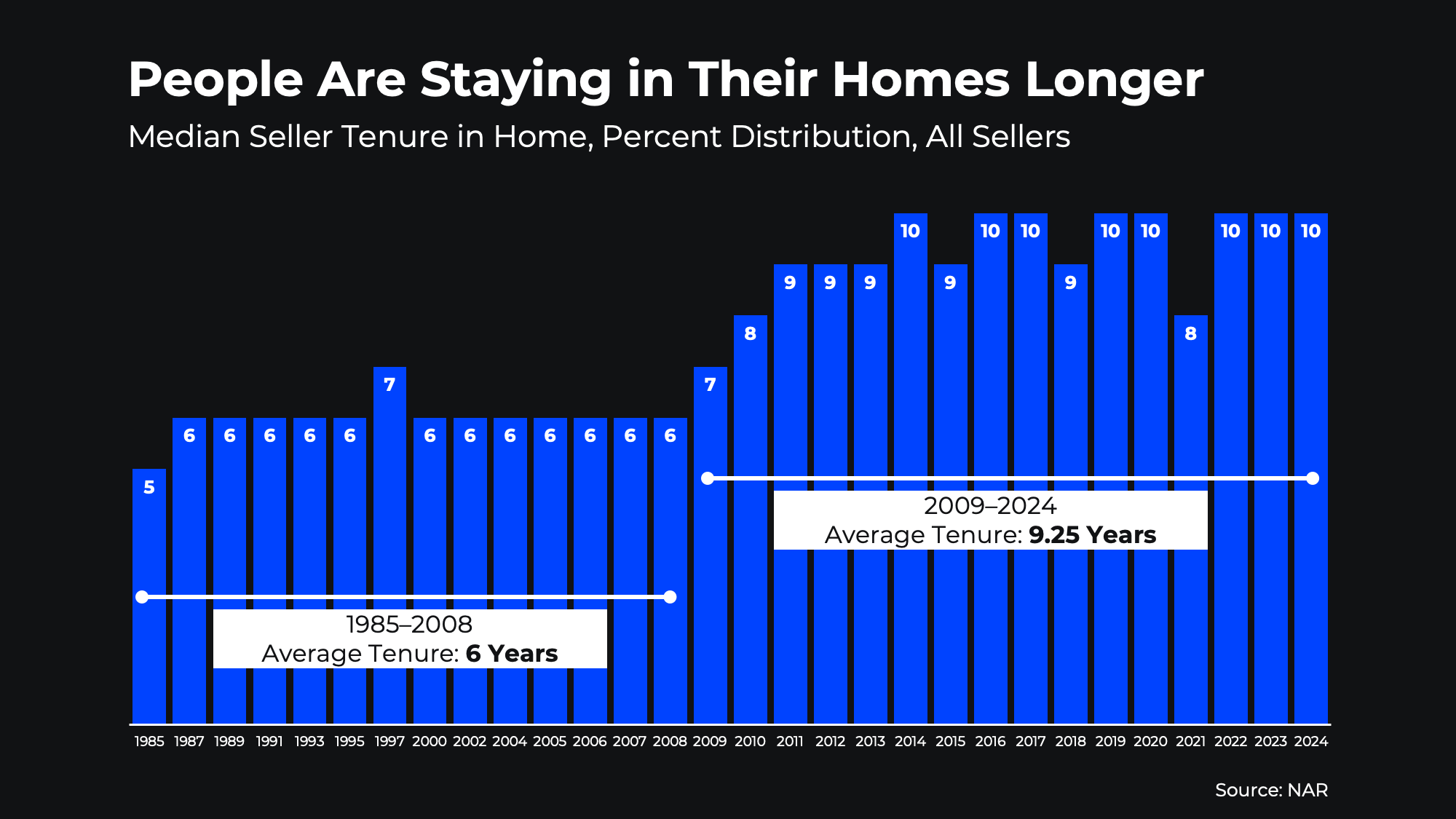

Data from the National Association of Realtors (NAR) also shows people are staying in their homes longer than they used to, with the average tenure now being close to 10 years (see graph below):

This increase means homeowners are benefiting even more from home values growing over time as they’re paying down their mortgages. That’s because the longer someone lives in their home, the more that home value grows, which directly increases equity.

This increase means homeowners are benefiting even more from home values growing over time as they’re paying down their mortgages. That’s because the longer someone lives in their home, the more that home value grows, which directly increases equity.

And if you’re one of those people who’s been in their home for 10 years or more, know this — according to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

The Benefits of Having Home Equity

What does this mean for you? Your house might be your biggest financial asset — and it could open some exciting opportunities for your future. Let’s break it down.

Moving to Your Next Home

Your equity could help you cover the down payment for your next home. In some cases, it might even mean you can buy your next home in all cash, especially if you’re looking to downsize or move to a less expensive area.

Financing Home Improvements

Thinking about upgrading your kitchen, adding a garage or tackling other key projects? If you do it right, your equity could provide the funds to make those improvements happen, increasing the value of your home and making it more enjoyable to live in, too.

Starting a Business

If you’ve been dreaming about starting your own business, your equity could be the kickstart you need to make it happen. Whether it’s for startup costs, equipment or marketing, leveraging your home’s value could help bring your entrepreneurial goals to life while driving your long-term earning potential forward.

Fueling Your Retirement

Your home equity could be the key to funding your next chapter, too. By downsizing or moving to a more affordable area, you can unlock cash to support your retirement goals or invest in the lifestyle you’ve been hoping for — all while simplifying your living situation.

Bottom Line

Whether you’re thinking about selling, upgrading or simply want to understand your options, your home equity is a powerful resource — and your trusted REMAX agent could help you understand exactly what you’re working with.

Want to find out how much your home is worth? Send me a quick reply, and I’ll do a professional assessment for you. The real number may surprise you.