If you stepped back from your home search over the past few years, you’re not alone – and you’re definitely not out of options. In fact, now might be the ideal time to take another look. With more homes to choose from, prices leveling off in many areas, and mortgage rates easing, today’s market is offering something you haven’t had in a while: options.

Experts agree, buyers are in a better spot right now than they’ve been in quite a long time. Here’s what they have to say.

Affordability Is Finally Improving

Lisa Sturtevant, Chief Economist at Bright MLS, says affordability is finally starting to turn the corner:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Mortgage rates have eased from their recent highs, price growth has slowed, and that one-two combo is making homes more affordable than they’ve been in months.

There Are More Homes on The Market

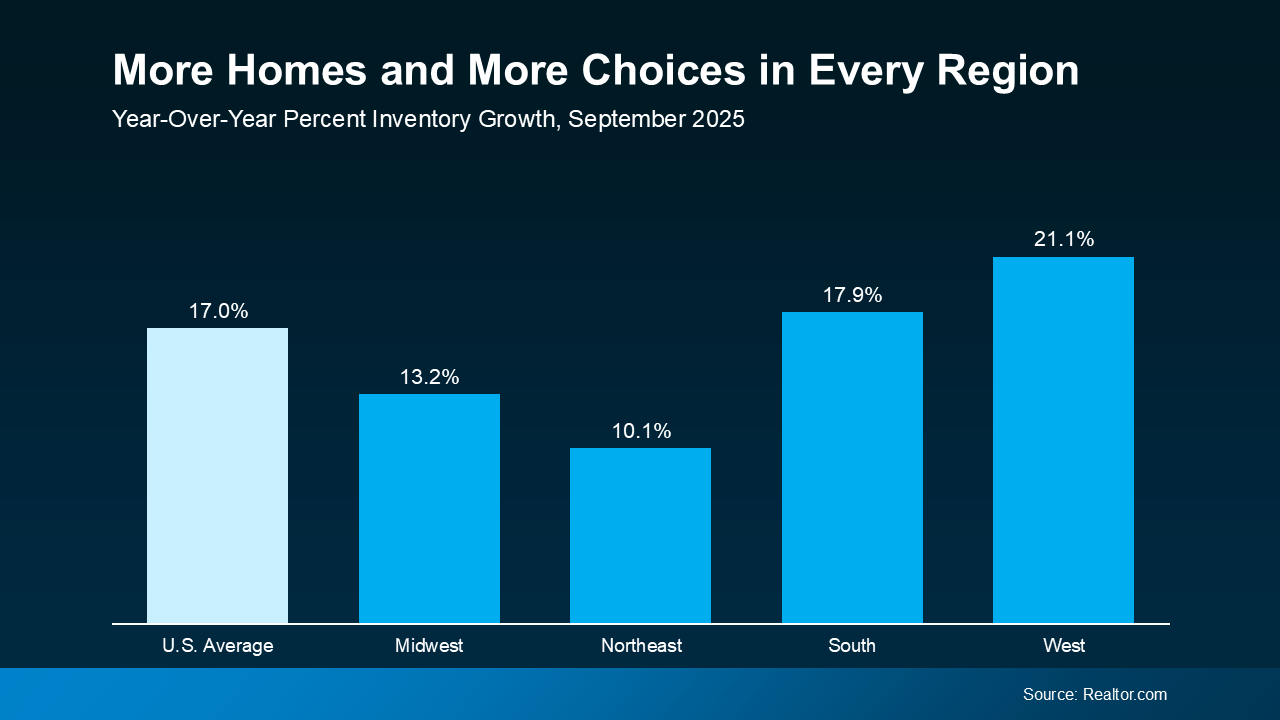

And a big reason prices are easing is because there are more homes on the market. According to the latest from Realtor.com, there are 17% more homes for sale today than there were at this time last year. That means more options, less competition with other buyers, and a chance to find the space that actually works for you.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), shares:

“Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price. Current inventory is at its highest since May 2020, during the COVID lockdown.”

Take a look at the numbers.

As Yun notes, inventory is up everywhere. Compared to this time last year, every region of the country has more homes on the market than at this time last year (see graph below):

That translates to more homes to choose from, whether you’re looking for a bigger backyard, a shorter commute, or finally ditching your rental.

That translates to more homes to choose from, whether you’re looking for a bigger backyard, a shorter commute, or finally ditching your rental.

But not all markets are the same…

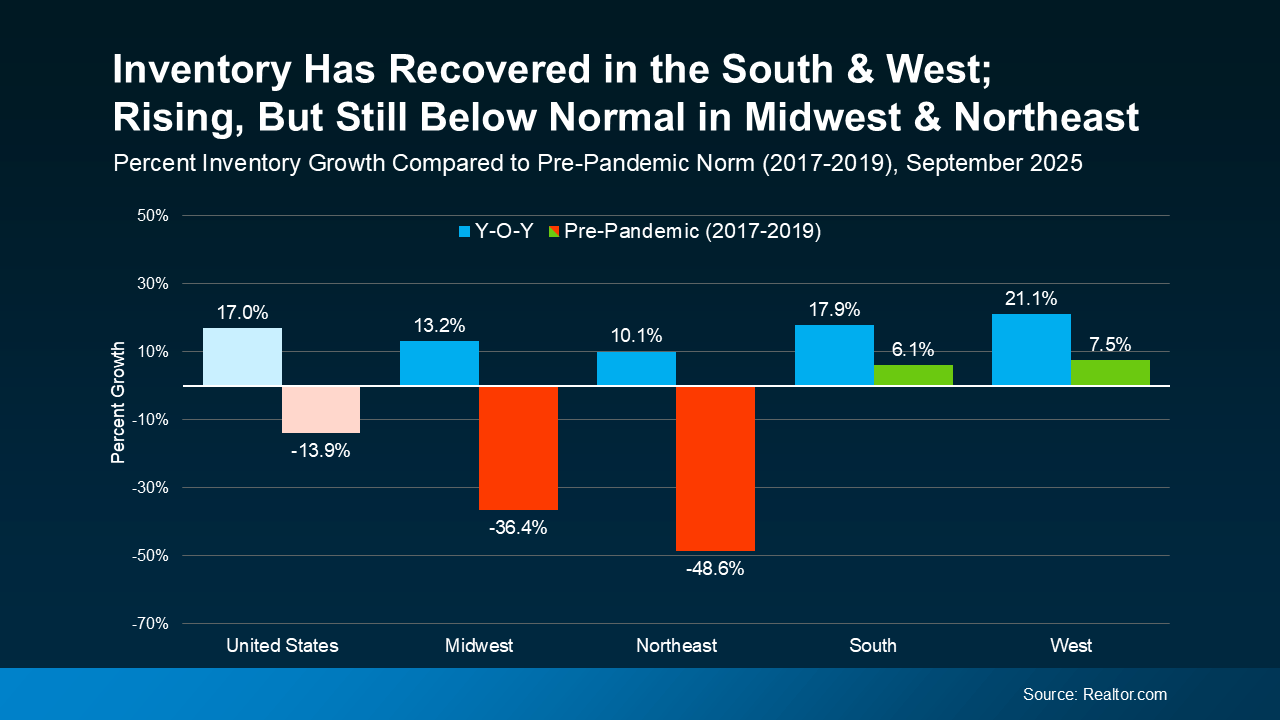

When you compare current inventory growth to pre-pandemic norms (2017–2019), the picture changes a bit, depending on where you are (see graph below):

The green bars show where inventory has fully recovered (and even grown above pre-pandemic levels) in the South and the West. Supply, however, is still tighter in the Northeast and Midwest, as shown in the red bars, where inventory is still below normal.

The green bars show where inventory has fully recovered (and even grown above pre-pandemic levels) in the South and the West. Supply, however, is still tighter in the Northeast and Midwest, as shown in the red bars, where inventory is still below normal.

And here’s why that’s still a win everywhere.

When you step back and look at the bigger picture, with inventory up in every region, that means more choices everywhere, even if some areas have more homes for sale than others.

And with fewer buyers in the market and more homes for sale, sellers are willing to negotiate to get a deal done.

All of that adds up to a win for today’s buyers.

And it’s also why working with a local expert really makes a difference. What’s happening in your zip code or neighborhood might look different than the national or regional trend. But the overall takeaway is clear: with more homes on the market, buyers have more leverage than they did a year or more ago.

So, if you stepped away from your search because things felt too competitive, too pricey, you were worried about finding a home, or it was all just too much to process, this could be your moment to take another look.

And if you’re not quite ready to go all in, that’s okay too. You can start by planning ahead. That means working with a trusted agent who can help you break down your budget, narrow your search, and make sure you're prepped and ready when the right home hits the market.

Bottom Line

Want to know what’s happening in your local market? Reach out to a trusted real estate agent and ask for a custom overview of what’s available right now, so you can learn how to be ready when the timing is right for you.

Because this isn’t 2021.

This isn’t even 2023 or 2024.

This is a new market – and you might be surprised by what you find.