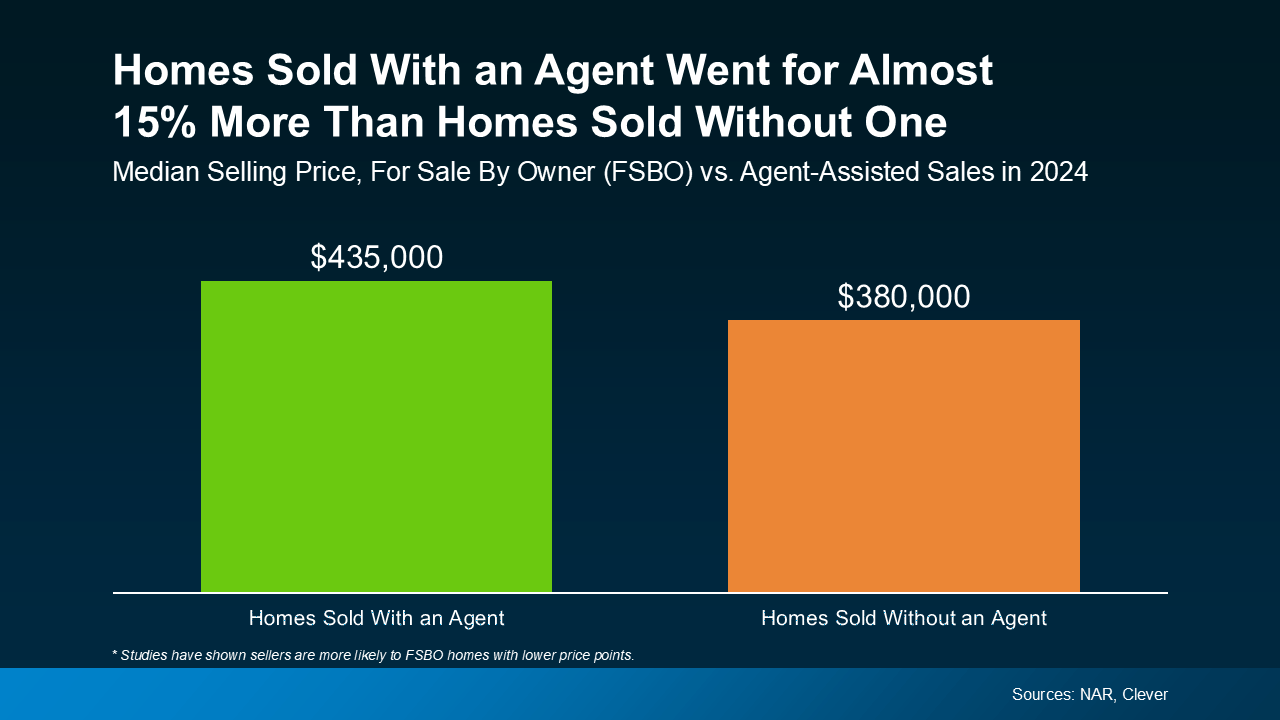

Cutting out the agent might seem like a smart way to save when you sell your house. But here’s the hard truth.

Last year, homes that sold with an agent went for almost 15% more than those that sold without one.

That gap is pretty hard to ignore. And with more homes on the market to compete with right now, selling on your own is a mistake that’s going to cost you.

That gap is pretty hard to ignore. And with more homes on the market to compete with right now, selling on your own is a mistake that’s going to cost you.

This Isn’t the Market for DIY Selling

A few years ago, you might’ve gotten away with a “For Sale By Owner” (FSBO) sign in your yard, navigating the process on your own. That’s because homes were flying off the market and buyers were pulling out all the stops. But that’s just not the case anymore. With more inventory than we’ve seen in years, we’re not in a “list it and they will come” market anymore. You need professional expertise.

A yard sign and some photos you take on your own won’t cut it.

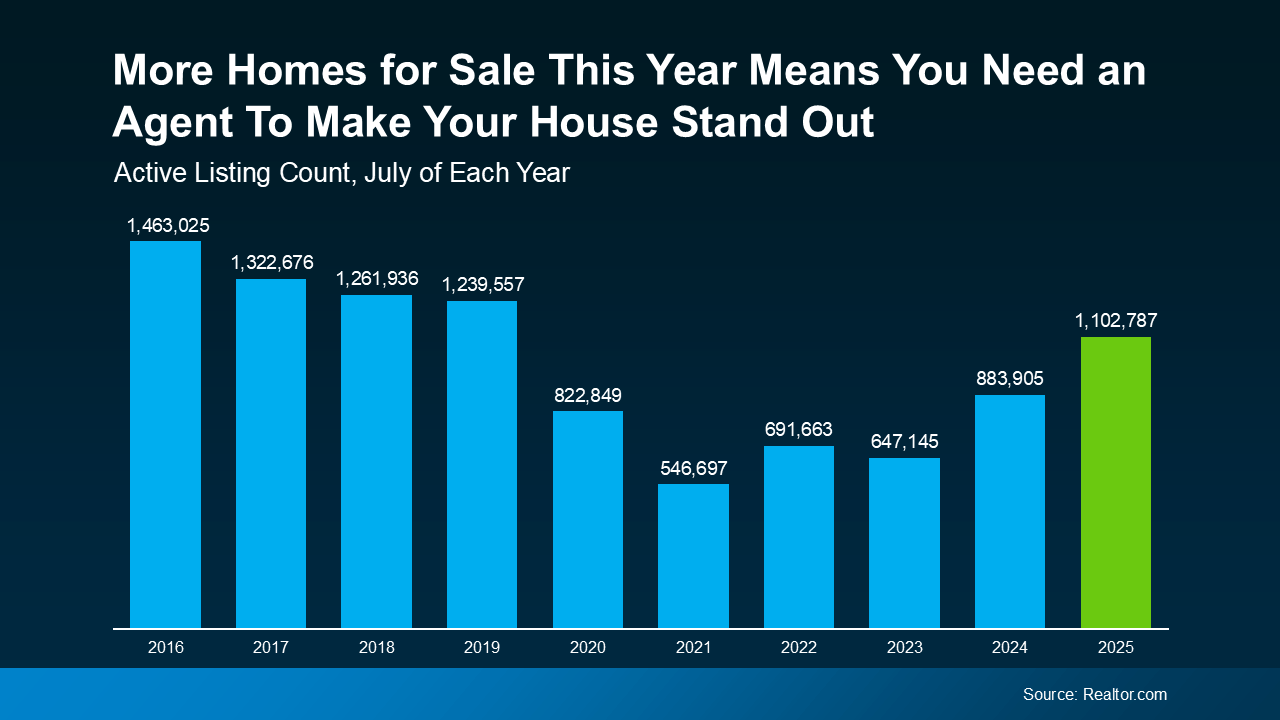

Right now, the housing market is getting back to what most would consider a more normal balance of buyers and sellers, and that really changes the game. According to Realtor.com, the latest number of listings for sale was the highest it’s been in any month of July since 2019 (see graph below):

And while inventory growth is going to vary by local market, nationally, this graph shows the number of homes for sale is inching back toward normal.

And while inventory growth is going to vary by local market, nationally, this graph shows the number of homes for sale is inching back toward normal.

With more listings available, that means buyers can be more selective. They’ll compare your home to others on price, condition, photos, location, and more. If yours doesn’t stand out, it will get skipped over.

More Inventory = More Competition for You

Selling today requires the latest pricing strategy, expert prep work, professional marketing, and strong negotiation skills. And if you’re not bringing all of that to the table, chances are, you’re going to feel it in your bottom line.

More Homeowners Are Turning To the Pros

That’s why even more home sellers are working with agents today. Data from the National Association of Realtors (NAR) shows a record-low percentage of homeowners sold without an agent last year. And the few sellers who tried to sell on their own realized their mistake pretty quickly.

According to Zillow, 21% of homeowners ended up hiring an agent anyway after struggling to sell on their own.

So, why take the risk? With a local pro, you'll have:

- Pricing precision to attract buyers and maximize your return

- Expert staging and presentation advice to highlight your home’s best features

- Pro-level marketing, including the best exposure and access to buyer networks you can’t reach on your own

- Skilled negotiation to evaluate offers and navigate inspections, protecting your bottom line

- Local market expertise that helps your listing stand out based on what inventory looks like in your area

An agent's expertise isn’t optional anymore. It’s essential.

Bottom Line

In a market with more listings and pickier buyers, many sellers who try to sell on their own end up working with an agent anyway. So why not start there?

Connect with an agent so you have a pro who knows exactly what it takes to sell your house in today’s market, for the best possible price, without leaving money on the table.

Reach out to an agent if you want a professional assessment on what your house could sell for today.